Putting it all Together: How To Evaluate and Select a Real Mutual Fund (Screenshots)

Mutual funds are a tremendous investment vehicle by which investors can build steady wealth. In a previous post, we highlighted 6 of many different things investors should consider when evaluating and selecting mutual funds. In this post, we are going to evaluate and select a specific mutual fund: a Fidelity® mutual fund.

Just a Recap...

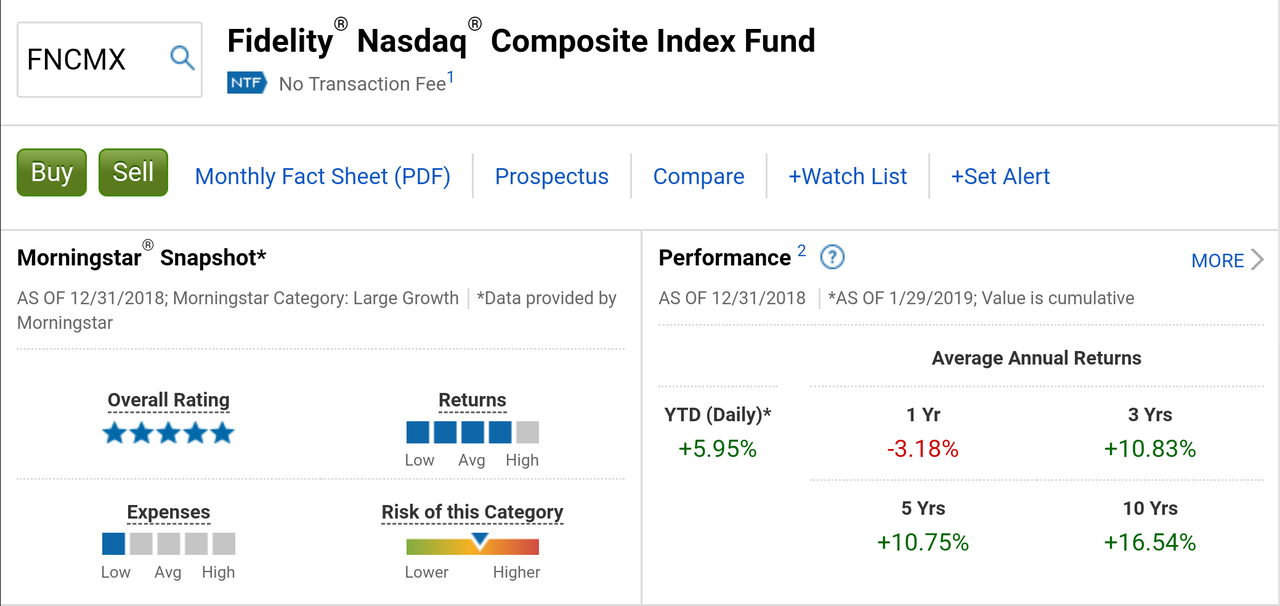

A mutual fund is characterized by a ticker symbol to distinguish it from other mutual funds. We are going to evaluate the Fidelity® Nasdaq® Composite Index Fund or FNCMX, an index mutual fund that tracks the NASDAQ Composite Index. Again, recall the 6 parameters we outlined: 1) mutual fund's performance; 2) expense ratio; 3) minimum investment amount; 4) overall rating and returns; 5) net asset value (NAV); 6) mutual fund's top 10 holdings. All information in this post are current as of the date this post is written. Information referenced in this post is subject to change and active links may become inactive. Let's evaluate mutual fund FNCMX.

1. Mutual fund's performance

A mutual fund's performance can give you a good idea of a its financial health. We typically look at a fund's performance over the last 1 year, 3 years, 5 years and 10 years and to some extent its YTD. FNCMX has posted some decent returns as you can see below. 3-year returns: +10.83%; 5-year: +10.75%; 10-year: +16.54%. Last year, particularly the last few months of 2018, was hard on stocks. Last year return was -3.18%. YTD performance so far stands at +5.95%. Overall, this mutual fund has posted some solid performance.

2. Net expense ratio

In very basic terms, the net expense ratio tells you how much the fund charges annually to operate it, after factoring out other expenses. It is usually expressed as a percentage. For example, an expense ratio of 0.50% means that you pay $50 for every $10,000 invested in that fund. For this fund, the net expense ration is a decent 0.3%. You pay roughly $30 for every $10,000 you have invested in that fund, after other expenses have been factored in. Use this simple tool to estimate your mutual fund fees and expenses.

3. Minimum investment amount

As of the date of this post, this fund does not have a minimum investment amount, as you can see in the above picture. The minimum investment is $0.00. You can start investing for as little as $1!

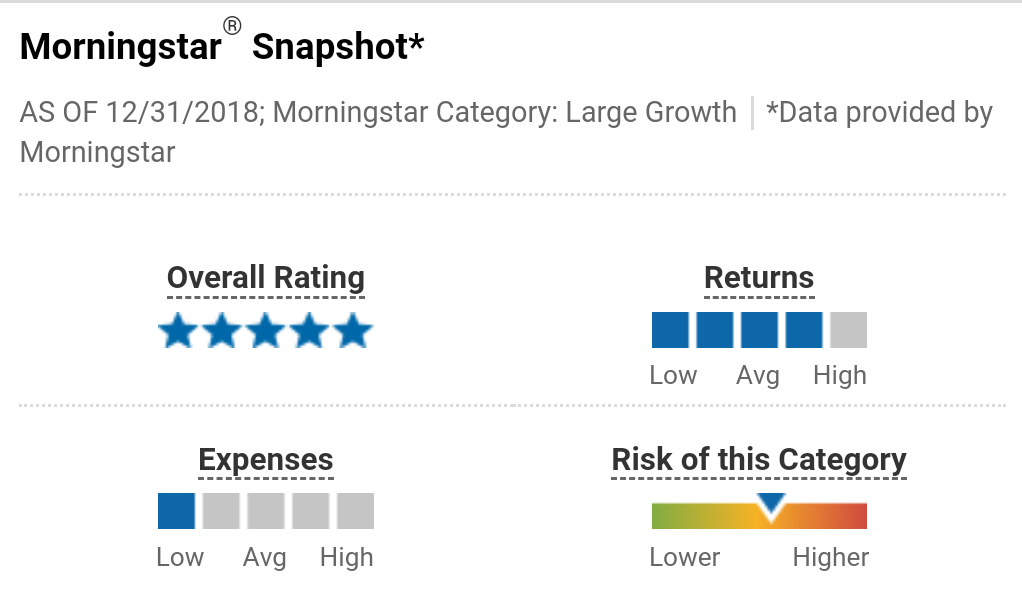

4. Overall rating and returns

Funds are rated on a star scale, ranging from 1 to 5 stars. Returns are classified from low to high. This mutual fund is rated 5 stars by Morningstar, a global investment research and management firm. In addition, returns for this fund are above average and expenses are low.

5. Net Asset Value (NAV)

The NAV or net asset value of a mutual fund is the dollar value of one mutual fund's share, excluding other fees. If the NAV of mutual fund X is $10.45, it means you need $10.45 to purchase one share of mutual fund X. For mutual fund FNCMX, the NAV as of 1/30/19 is $91.19. Since this is a No Transaction Fund from Fidelity®, if you want to buy 1 share of this mutual fund, you need $91.19.

6. Mutual fund's top 10 holdings

Mutual funds can have anywhere from tens to several hundreds or thousands of stock, bonds or other securities. The top 10 holdings of a mutual fund is usually listed to give you an idea of where the fund invests a good portion of its money in. As of the date of this post, this mutual fund has an astonishing 2074 holdings in its portfolio. The top 10 holdings comprise 32.11% of this mutual fund's portfolio (Microsoft, Apple, Amazon, Google, Facebook, Intel, Cisco, Pepsi, Comcast).

The bottom line

Investing in mutual funds is a good way to build a diversified portfolio and minimize risks. After reading this post, you should be able to evaluate a mutual fund and decide whether the fund is one you want to invest in. A few parameters to consider include, but are not limited to a mutual fund's performance, expense ratio, investment minimum, overall rating and returns, net asset value (NAV), and the fund's top 10 holdings. Other honorable mentions include the fund's objective, strategy and risks. You can take a look at Fidelity® Nasdaq® Composite Index Fund (FNCMX)'s investment objective, strategy and risk here by scrolling to the bottom. Based on this analysis, we can conclude that the Fidelity® Nasdaq® Composite Index Fund (FNCMX) is a pretty solid index mutual fund.

Like this article? Please share and leave us your feedback in the comment section and help us improve and grow. Subscribe below to get our latest articles. Here are a few more articles you may find useful: I buy the U.S. economy with a single index fund. The initial result is stunning! | How to earn free money as a micro investor | How to invest $100 | How to invest $50 | The engines that power stock market wealth | Cash is trash, not king. Invest it! | Stocks vs. index funds vs. ETFs: what's the difference?

Related Posts

Comments

By accepting you will be accessing a service provided by a third-party external to https://www.newvestor.com/